child tax portal update dependents

At some point the portal will be updated to. The IRS is yet to release any information about when it will be possible to update dependent details on the portal.

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

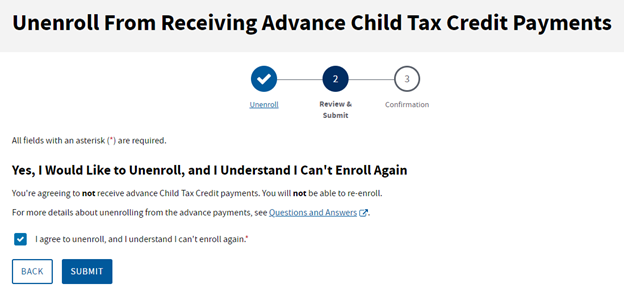

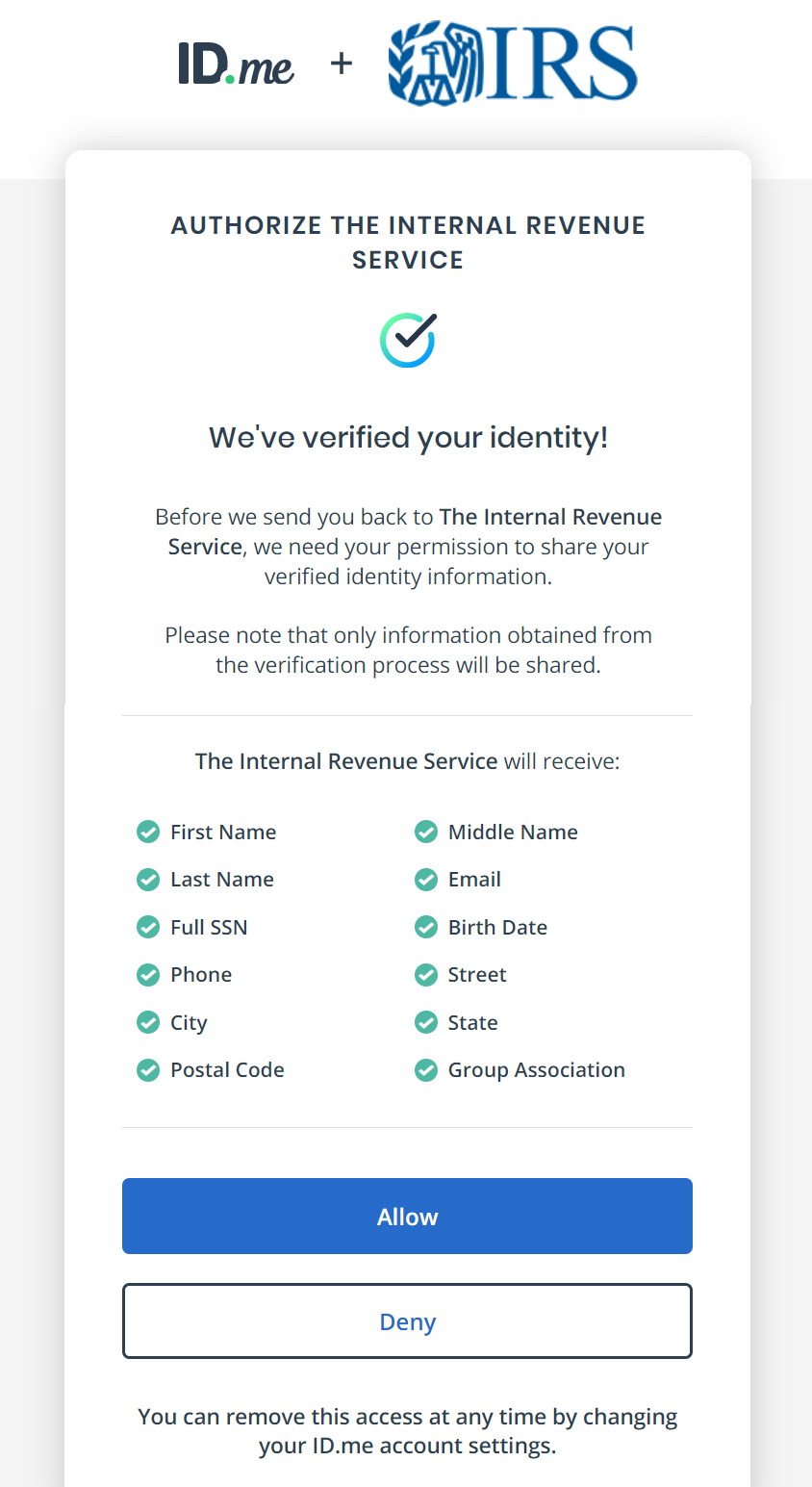

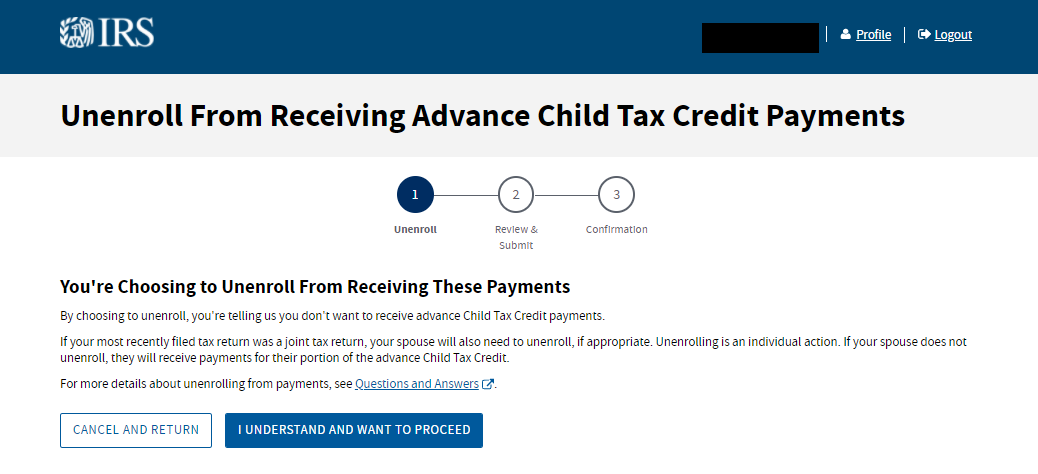

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child.

. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. The IRS will add more features. Heres how they help parents with eligible dependents.

Soon people will be able update their mailing address. At some point the portal will. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit.

Half of the money will come as six monthly payments and half as a 2021 tax credit. The Child Tax Credit Non-filer Sign-up Tool and Child Tax Credit Update Portal are external links from the IRS website and are only. The IRS has launched their Child Tax Credit Update Portal to assist taxpayers in managing and monitoring advance monthly payments of the Child Tax Credit.

It says on the IRS website that the first payment will be based upon the dependents you put on your 2019 2020 tax return. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall. Families can now report income changes using the Child Tax Credit Update Portal.

The IRS will pay 3600 per child to parents of young children up to age five. How to sign up for the Child Tax Credit. The Child Tax Credit Update Portal can be used by families to update the information the IRS has for them that may make them eligible for the credit.

Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. The IRS will pay 3600 per child to parents of young children up to age five. The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a.

By fall people will be.

Child Tax Credit Update Irs Launches Two Online Portals

New Irs Portal For 3600 Child Tax Credit 8 000 Dependent Credit Youtube

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Bank Information Can Now Be Updated On Child Tax Credit Portal Journal Of Accountancy

About The Child Tax Credit Momsrising

Child Tax Credit Health And Human Services Montgomery County

How To Get The Advance Child Tax Kandit News Group Facebook

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Taxes 2022 Important Changes To Know For This Year S Tax Season

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

![]()

Child Tax Credit Update Irs Launches Two Online Portals

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit The White House

The Latest Updates On The Child Tax Credit

Five Facts About The New Advance Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back